Social Security Tax Limit 2025 Withholding. You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Thus, an individual with wages equal to or larger than $168,600.

The social security tax rate remains at 6.2 percent. Income, and income alone, dictates whether you owe federal taxes.

Limit For Maximum Social Security Tax 2025 Financial Samurai, A proposal to end federal tax on social security retirement benefits would provide relief for retirees as early as next year. Here are seven things social security recipients, present and future, should know about taxation of benefits.

Maximum Withholding Social Security 2025 Marty Hendrika, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each. In 2025, the social security wage base limit rises to $168,600.

Social Security 2025 Limits Aili Lorine, You file a federal tax return as an individual and your combined income is between $25,000 and $34,000. We raise this amount yearly to keep pace with increases in average wages.

How To Calculate, Find Social Security Tax Withholding Social, Up to 50% of your social security benefits are taxable if: So, how does that affect the maximum benefit limit?

How Much Is Social Security Tax In 2025 Wynny Dominica, All covered wages are subject to medicare tax. Last updated 12 february 2025.

Maximum Withholding For Social Security 2025 Sara Nellie, So, how does that affect the maximum benefit limit? For earnings in 2025, this base is $168,600.

50 Essential Tips Maximizing Tax Withholding on Social Security 2025, Mike mccluskey, senior technical editor, calchamber. You file a federal tax return as an individual and your combined income is between $25,000 and $34,000.

Social Security Taxable Limit, Maximum taxable earnings each year. You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes.

How To Withhold Taxes On Social Security Benefits YouTube, This amount is known as the maximum taxable earnings and changes each year. Mike mccluskey, senior technical editor, calchamber.

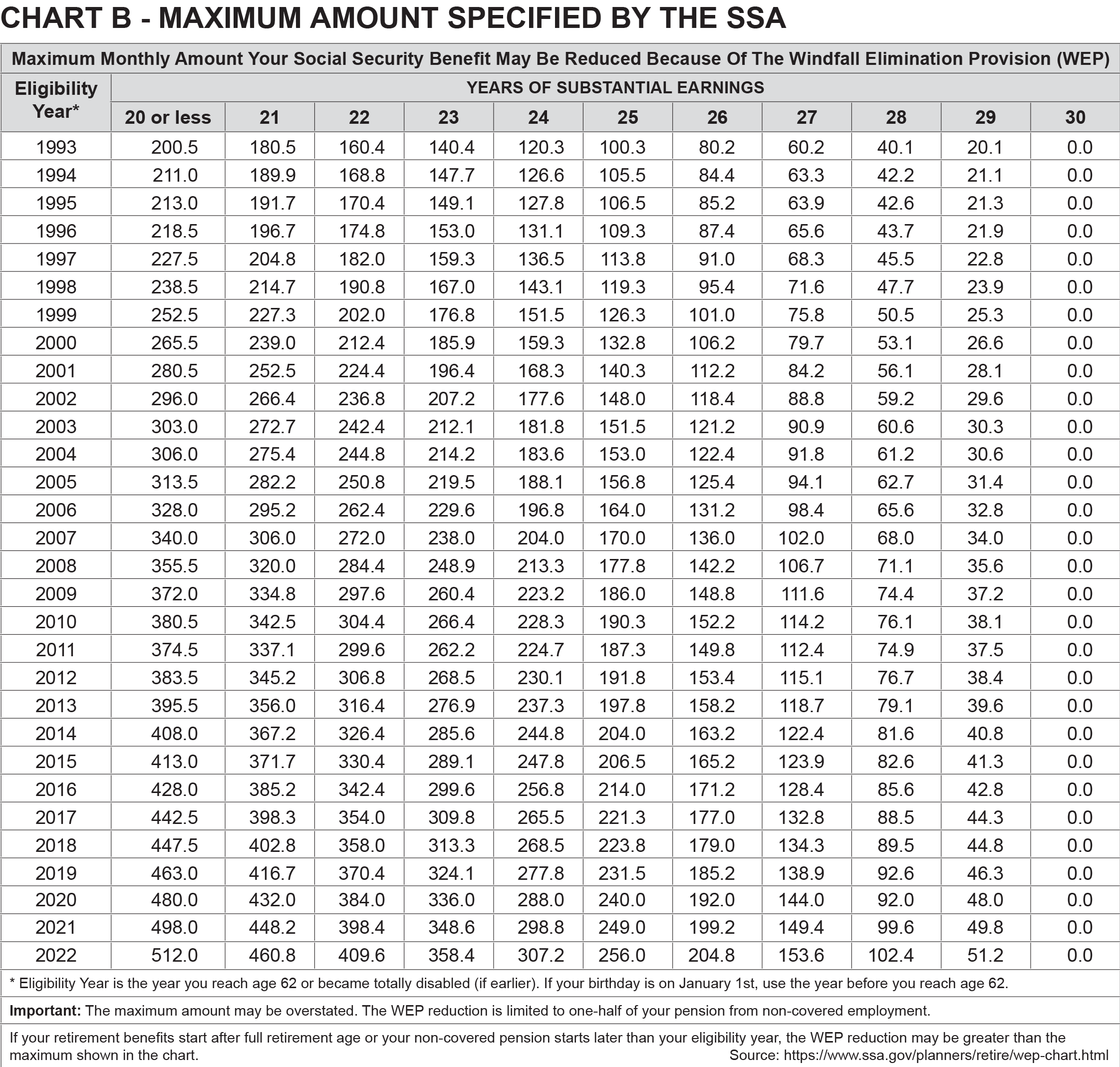

Maximum Taxable Amount For Social Security Tax (FICA), For 2025, an employer must withhold: Workers earning less than this limit pay a 6.2% tax on their earnings.